#396

New Frontiers

This past weekend marked the start of space tourism with Richard Branson’s successful space flight aboard Virgin Galactic’s SpaceShipTwo. Next week, we’ll see Jeff Bezos board Blue Origin’s New Shephard rocket as the space race heats up!

Much like billionaires are rushing towards the last frontier, 2021 is pushing the limits of retail participation in startup funding. This past week, Revolut raised $800m at a $33b valuation, making millionaires of 100 investors that participated in Revolut’s 2016 crowdfunding campaign.

Fintech companies are leading the charge opening a new frontier for retail investors to get early access to pre-IPO opportunities. Last week’s much anticipated announcement of Robinhood’s IPO came with news that the company is reserving 20-35% of IPO shares for customers. Outside of the US, European consumers have even more options to participate in startup upside earlier. Startups, PrimaryBid and Crowdcube launched in Europe, allowing retail investors to participate in private market transactions.

Though we have seen successes of retail participation in private market transactions, there are still many risks. Importantly, retail investors tend to be adversely selected given the limited availability of startup deals on early access and crowdfunding platforms.

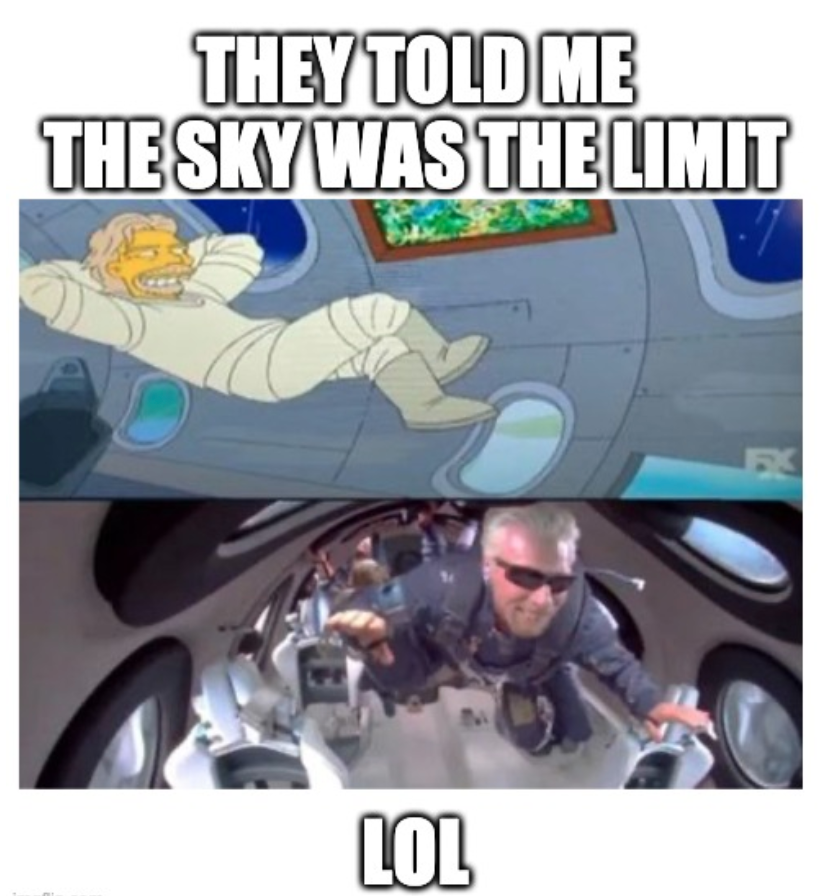

We look forward to more fintech leadership in increasing access to capital markets for retail investors. Barriers are meant to be broken… 7 years ago Homer Simpson predicted that Branson would make it to space. Homer’s record is the envy of Wall Street; maybe it's time he quit his day job at the power plant and joined r/wsb #tendies 🚀

|

New Frontiers

Nutmeg delivers returns to crowdfunding investors, industry needs more news like this - Nutmeg offered shares to retail investors on Crowdcube back in 2019. At that time, it raised £3.8m in equity capital with 2168 smaller investors. Nutmeg then raised at a pre-money valuation of £251m, thus indicating a return of over 2X for crowdfunding investors. Read more.

Some UK VC firms opening funding rounds to individual investors - Venture capital company Forward Partners is joining Draper Esprit and Augmentum in opening early-stage funding rounds and public offerings to individual investors via the PrimaryBid platform. London-headquartered Forward Partners is including individual investors in an upcoming IPO that aims to raise £30m. Read more.

Industry News

African start-ups attract international investors — but need local ones too - Africa, a region long defined by fragmentation, is ripe for innovation in finance. With a median age of 19, there is a raw entrepreneurial energy in cities such as Cairo, Johannesburg, Lagos and Nairobi. Young entrepreneurs like the founders of portfolio company Flutterwave are starting to invest locally and fill the void. Read more.

Apple may squash the buy now, pay later party - Apple's reported foray into buy now, pay later (BNPL) has sent the shares of specialists reeling. Afterpay and Zip of Australia and US-listed Affirm all lost about a tenth of their equity value on the news. It would be no surprise if BNPL piqued Apple’s interest at a touted total addressable market size of $30tn. Read more.

Apollo joins forces with blockchain startup Figure - Apollo Global Management will collaborate with blockchain lending startup Figure Technologies on a series of initiatives as the alternative asset manager sharpens its focus on innovation in financial technology. Read more.

BlackRock CEO calls for stronger climate finance plan at G20 meet - At a G20 summit, BlackRock CEO Larry Fink called for governments to develop a stronger long-term climate finance plan to fund the transition to a low-carbon economy. Fink also called for reform of the IMF and the World Bank to make them more suited to tackle the challenge of climate change. Read more.

Boubyan Bank proudly launches the world's first Islamic international digital bank - Boubyan Bank Group announced the launch of Nomo, a fully licensed and regulated UK Islamic digital bank catering for customers with a global financial outlook. Read more.

Brazil’s SEC approves first Ethereum ETF in Latin America - Several months after green lighting a Bitcoin ETF, Brazil’s watchdog has done the same for a product tracking the performance of the second-largest cryptocurrency – ETH. The fund will be managed by QR Asset Management. Read more.

Klarna acquires HERO to enhance social shopping - Payments and shopping platform Klarna is partnering with social shopping startup HERO to bring retailers a solution to create shoppable content right from their brick-and-mortar location. Read more.

N26 eyes value of about $10b in fresh fundraising - N26 is holding discussions with investors to raise several hundred million dollars in a fundraising that could value the German fintech at about $10b. This is hot on the heels of digital banking rival Revolut raising $800m from investors including SoftBank at a $33b valuation. Read more.

SoftBank-backed Paytm targets record $2.2b India IPO - The startup backed also by Berkshire Hathaway and Jack Ma’s Ant Group plans to raise as much as 166b rupees from its share sale. The IPO will include an equal amount of new and secondary shares, according to a Draft Red Herring Prospectus. Read more.

Select Financings

Cape Analytics - San Francisco based insurance analytics platform raised $44m in Series C funding led by Pivot Investment Partners. Read more.

Cardless - San Francisco based next gen credit card platform raised $40m in Series B funding led by Activant Capital. Read more.

Flash - Brazil based benefits management platform raised $22m in Series B funding led by Tiger Global. Read more.

Jasper Card - South Dakota based neo-credit card provider focused on cashback raised $34m in Series A funding led by Strathmore Group and Benslie International. Read more.

LinkSquares - Massachusetts based contract analytics platform raised $40m in Series A extension funding led by Sorenson Capital. Read more.

Lunar - Denmark based challenger bank raised €210m in Series D funding led by Tencent, Kinnevik and Heartland. Read more.

M1 Finance - Chicago based robo-advisory investment platform raised $150m in Series E funding led by SoftBank at a post money valuation of $1.45b. Read more.

Marco Financial - Florida based LATAM focused export loan platform raised $7m in seed funding led by Kayyak Ventures. They also raised a $75m credit line. Read more.

Morty - New York based online mortgage platform raised $25m in Series B funding led by March Capital at a post money valuation of $150m. Read more.

Railsbank - London based credit card as a service platform raised $70m led by Anthos Capital. Read more.

Revolut - London based global challenger bank and personal finance platform raised $800m in Series E funding led by Tiger Global and SoftBank at a post money valuation of $33b. Read more.

Syfe - Singapore based investment platform raised $30m in Series B funding led by Valar Ventures. Read more.

Tinvio - Singapore based financial services platform for supply chain merchants raised $12m in Series A funding led by AppWorks Ventures. Read more.

Tide - London based business banking platform raised $100m in Series C funding led by Apax Partners at a post money valuation of $650m. Read more.

YuLife - London based life insurance and wellbeing platform raised $70m in Series B funding led by Target Global at a post money valuation of $347m. Read more.

FinTech Collective Newsletter

Curated News with Context

Delivered every Saturday, the weekly newsletter, produced by our team, provides a tightly edited rundown of global fintech news, along with a bit of our original analysis.